Chapter 8 Being Attentive to Cycles

Sentences & Collocations Bank:

credit cycle 信贷周期

Contrarian 逆行者

bargain hunting 逢低买入

Things will wax and wane, grow and decline. 万物有起有落有增有衰

Success carries within itself the seeds of failure, and failure the seeds of success.

Oversupply of a good leads to a price decline and lower profits.

Summary:

Everything is cyclical caz people are involved. (Some of the greatest opportunities for gain and loss come when other people forget it)

You Can’t Predict. You Can Prepare.

Credit cycle: the worst loans are made at the best of times.

Ignoring cycles and extrapolating trends is one of the most dangerous things an investor can do.

Chapter 9 Awareness of the Pendulum

Summary:

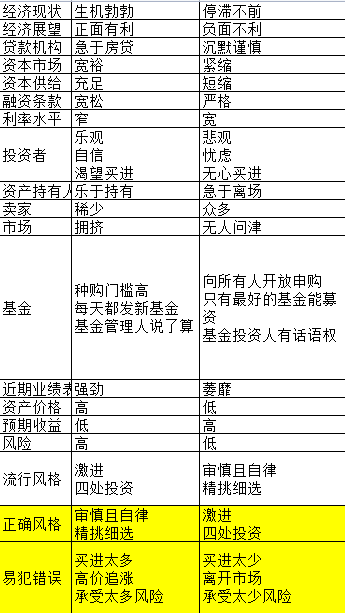

The pendulum-like oscillation of investor attitudes and behavior

There are two risks in investment: the risk of losing money and the risk of missing opportunity.

At one extreme of the pendulum, people think things will never get better. The few people who possess those qualities can make unusual profits with low risk. But at the other extreme, when everyone assumes that prices will increase forever, the stage is set for painful losses.

The pendulum should reside mostly at a midpoint between the extremes. This means markets will always create opportunities, whether now or later so we need to be patient.

Chapter 10 Combating Negative Influences

Sentences & Collocations Bank:

be at the mercy of 任凭 受制于

perverse incentives 不正当的激励

hindsight 后见之明

willing suspension of disbelief. 愿意中止怀疑

capitulation 投降

Initial public offerings 首次公开发行募股 IPO 一家企业或公司(股份有限公司)第一次将它的股份向公众出售

broker 经纪人

The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.

Much of this falls under the heading of“human nature.” 归属于什么的范畴

It’s a good field in which to vent their competitiveness. 这是个发泄竞争力的好地方

I want to mention a phenomenon I call capitulation, a regular feature of investor behavior late in cycles.

Summary:

Psychological influences have great power over investors.

1) Greed leads people to pursue unrealistic returns and ignore risks.

2) Fear is overdone concern that prevents investors from taking constructive action when they should.

3) Self-deceit/ willing suspension of disbelief is people’s tendency to dismiss logic, history and time-honored norms.

4) Conformity, even though people are obviously wrong.

5) Envy. Most people find it terribly hard to sit by and watch while others make more money than they do.

6) Ego. People are obsessed with short-term ego gratification rather than long-term wealth accumulation.

Investors hold to their convictions as long as they can, but when the economic and psychological pressures become irresistible, they surrender and jump on the bandwagon.

Chapter 11 Contrarianism

Summary:

In the long run, the market gets it right. But you have to survive over the short run, to get to the long run.

Superior investors with second-level thinking are the opposite of trend followers. They have a strongly held sense of intrinsic value.

Investment success requires sticking with positions made uncomfortable by their variance with popular opinion.

The price of an investment can be lower than it should be only when most poeple don’t see its merit.

Skepticism: we must be skeptical of the optimism that thrives at the top, and skeptical of the pessimism that prevails at the bottom.

Chapter 12 Finding Bargains

Sentences & Collocations Bank:

caveats 警告 附加说明

tech-stock mania 科技股狂热

The tendency to mistake objective merit for investment opportunity, and the failure to distinguish between good assets and good buys, get most investors into trouble.

The story of bonds in the last sixty years is the mirror opposite of the rise in popularity enjoyed by stocks.

Summary:

Our goal isn’t to find good assets, but good buys. It’s not what you buy; it’s what you pay for it.

Your portfolio construction:

(a) a list of potential investments

(b) estimates of their intrinsic value

© a sense for how their prices compare with their intrinsic value(the ratio of potential return to risk)

(d) an understanding of the risks involved in each

What is good buy? Price is low relative to value, and potential return is high relative to risk.

Figuring out what causes an asset to be out of favor. It’s important to think about the psychological forces behind it and the changes in popularity that drive it.

1) objective defect

2) irrationality or incomplete understanding of assets.

3) asset is ignored or scorned

Neither fairly priced asset nor overpriced asset is our objective. Our goal is to find underpriced assets.

Shopping list:

• little known and not fully understood; 行业比较小众或者尖端

• fundamentally questionable on the surface; 表面看商业逻辑有问题

• controversial, unseemly or scary; 有争议 不体面 令人害怕(不符合当下舆论也算)

• deemed inappropriate for “respectable” portfolios; 不能称之为值得尊重的投资组合

• unappreciated, unpopular and unloved;

• trailing a record of poor returns; 历史表现不好

• recently the subject of disinvestment, not accumulation.

Chapter 13 Patient Opportunism

Sentences & Collocations Bank:

The boom-bust cycle

stakes 赌注 风险

reaching for yield=reaching for return 追求回报

Calibration校准

BWIC, pronounced “bee-wick,” came into common use, an acronym for “bid wanted in competition.”

we must invest appropriately for the circumstances with which we’re presented.

our environment will change in ways beyond our control.

Experience and versatile thinking are the keys to such calibration.

Summary:

Rather than initiating transactions, we prefer to react opportunistically.

It’s unwise to think of:

(a) acting without recognizing the market’s status

(b) acting with indifference to its status

© believing we can somehow change its status.

Put risk control ahead of full participation in gains.

The absolute best buying opportunities come when asset holders are forced to sell regardless of price, and in crises they were present in large numbers.

• The funds they manage experience withdrawals.

• Their portfolio holdings violate investment guidelines such as minimum credit ratings or position maximums.

• They receive margin calls because the value of their assets fails to satisfy requirements agreed to in contracts with their lenders.

What we need:

Patient opportunism + a contrarian attitude + a strong balance sheet

In detail:

Firm reliance on value + little or no use of leverage + long-term capital + a strong stomach

Chapter 14 Knowing What You Don’t Know + 15 Having a Sense for Where We Stand

Sentences & Collocations Bank:

forgone 放弃

whether they view the future as knowable or unknowable.

Human beings are prone to make forecasts (it appears to be part of our natural wiring)

People in “I know” school are too confident but hardly keep their own forecasting track record.

Summary:

A. Be very careful with forecasts

Risk and uncertainty aren’t the same as loss, but they create the potential for loss when things go wrong. Some of the biggest losses occur with overconfidence and underestimate.

Acknowledging the boundaries of what you can know—and working within those limits rather than venturing beyond—can give you a great advantage. On the other hand, being unduly modest about what you know can result in opportunity costs (forgone profits).

We need:

1) diversifying,

2) hedging,

3) levering less (or not at all),

4) emphasizing value today over growth tomorrow,

5) staying high in the capital structure,

6) generally girding for a variety of possible outcomes.

B. Figure out where we are in terms of cycles and pendulums, and what that implies for our actions

(a) stay alert for occasions when a market has reached an extreme,

(b) adjust our behavior in response,

© refuse to follow the crowd irrationally at tops and bottoms.

Check List